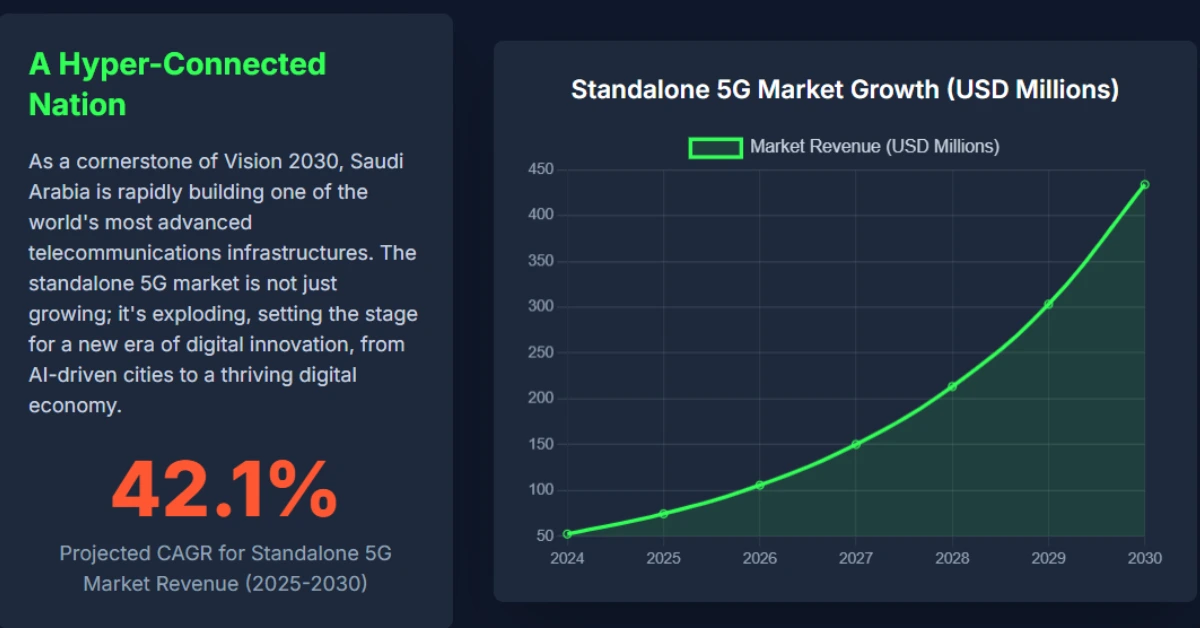

Saudi Arabia 5G has moved from promise to a national project. The Kingdom’s mobile operators are no longer just selling faster phones — they’re building the digital backbone for NEOM, the Hajj experience, and dozens of industrial sites. The government’s push under Vision 2030 has turned 5G into a strategic priority, and operators are answering with different playbooks: scale, pure technology, and green inclusion.

A national plan, three different plays

The Communications, Space and Technology Commission (CST/CITC) has framed spectrum policy and auctions as catalysts for nationwide 5G growth. The recent allocation of 600 MHz, 700 MHz and 3.8 GHz bands helped give operators the tools to expand reach and capacity — and the state has signalled that telecom is part of the Vision 2030 engine for jobs and diversification.

At the same time, operators are staking out distinct positions. STC is using scale and broad coverage; Mobily is chasing technical leadership and record trials; Zain is targeting fast expansion, pilgrim hotspots and sustainability. The result is a three-way race that is already changing how Saudis — and Saudi industries — connect.

Why 5G matters for Vision 2030

Saudi leaders see 5G as infrastructure, not a luxury. Smart cities such as NEOM and The Line require low-latency automation, private networks for industry, and pervasive coverage for tourism and health services. Public projects and giga-developments drive predictable demand for private 5G slices, fixed wireless access (FWA), and verticalized solutions in manufacturing and airports. CITC’s spectrum moves and public-private programs are explicitly designed to accelerate that shift.

STC: nationwide scale and infrastructure depth

STC leverages its incumbent position to build reach. By the end of 2024 the group reported commissioning hundreds of 5G sites and deploying thousands of second-layer sites, pushing its cumulative 5G site inventory into the high thousands and strengthening fiber backhaul to support growth. STC says it is moving beyond city centers to include remote reserves and strategic national projects.

STC’s playbook is simple: keep the lead on coverage and pair it with enterprise programs (for example, the “5G for Business” initiatives with major vendors) so airports, factories and large venues can run dedicated private 5G environments. Opensignal and other independent observers still rank STC highly on overall download and upload speeds, underlining that scale is paired with competitive performance.

- The Ultimate Guide to Zain KSA Codes – Balance Checks, Offers & More 2025

- Ultimate Guide to Mobily SIM Codes in Saudi Arabia [2025 Updated]

- Complete STC SIM Codes List for Saudi Arabia – Updated 2025

Mobily: technical trials and performance labs

Mobily has chosen differentiation through engineering. The operator has run high-impact trials — including a global-first six-component carrier aggregation (6CC) test on a live 5G Standalone network that produced a downlink throughput of 4.2 Gbps. That work is more than bragging rights: it proves the operator can aggregate spectrum to support ultra-high bandwidth services such as immersive AR/VR or very high-capacity FWA.

Mobily also tests new operational models, such as neutral-host shared indoor 5G, which can cut deployment costs and speed delivery inside stadiums, malls, and enterprise campuses. The technical focus helps Mobily win specific performance awards in areas like upload speed and consistent video experience.

Zain: targeted expansion, pilgrims, and green credentials

Zain took a bold, high-visibility approach. In 2024–25 the operator announced a SAR 1.6 billion investment plan to expand 5G coverage from dozens of cities to well over a hundred governorates — explicitly including full coverage of the Holy Sites used by millions of pilgrims. That plan pairs network expansion with digital services for pilgrims and citizens alike.

Zain also partnered with Red Sea Global to create what they describe as the world’s first zero-carbon 5G network at The Red Sea destination — a solar-powered, low-emissions deployment designed for high-end tourism and ecological sensitivity. This environmental angle gives Zain a distinct brand story and practical benefits where energy supply is constrained.

The road to 5G-Advanced and 6G readiness

Operators are already investing in the technologies that form the bridge to 5G-Advanced and eventual 6G: cloudified cores, network slicing, carrier aggregation, and AI-driven automation. STC’s Open RAN proof-of-concepts and cloud initiatives, Mobily’s aggregation and slicing experiments, and Zain’s capital allocation for 5G-A build a shared baseline for future innovation. Industry timelines point toward IMT-2030 conversations for 6G, but the practical work — common software stacks, trials, and spectrum harmonization — is happening now.

Comparative snapshot (table)

Below is a compact view of how the three operators differ in focus and capability.

| Operator | Primary Strategy | Expansion Focus | Notable Tech / Differentiator |

|---|---|---|---|

| STC | Nationwide leader, platform play | Urban + remote reserves; enterprise private 5G | Large 5G site inventory (thousands); Open RAN PoC; strong fiber backhaul. |

| Mobily | Technical innovator | High-density urban, enterprise, trials | 6CC 4.2 Gbps trial with Ericsson & MediaTek; shared indoor 5G pilots. |

| Zain | Challenger; inclusion + sustainability | Fast city expansion; Holy Sites & tourism | SAR 1.6B expansion plan; zero-carbon 5G at Red Sea project. |

Reality check: user experience and gaps

Independent measurements show STC often leads in overall download speed and coverage experience, while Mobily scores highly in upload and consistent video quality. But the transition to 5G Standalone (SA) — the version of 5G that removes 4G anchors — remains a moving target for consistent user experience. Some users still report cases where 4G felt more stable for routine tasks, highlighting the practical challenges in migration and device ecosystem readiness.

What this means for businesses and consumers

For enterprises picking a partner, the choice matters: manufacturers and campuses needing private, low-latency networks should weigh STC and Mobily’s private-network offerings and technical depth. Rural businesses and road-connected services may benefit from STC’s broad reach, while urban-focused companies requiring peak throughput or sustainability credentials may find Mobily or Zain a better strategic fit. Policy-makers and planners should treat operator choice as strategic procurement, not just price shopping

Conclusion: steady build, diverse approaches, cautious optimism

Saudi Arabia 5G is not a single story — it’s three parallel strategies tied to one national goal. The CST/CITC’s spectrum policy and Vision 2030 investments create demand; STC, Mobily and Zain respond with scale, engineering breakthroughs, and green/coverage bets. The coming five years will show which elements deliver at scale: private 5G for Industry 4.0, SA network maturity for reliable mass use, and targeted green deployments for tourism and sensitive sites. For now, the Kingdom has the pieces in place — and the global telecom community is watching how the Saudi playbook matures

Hey, I’m Arafat Hossain! With 7 years of experience, I’m all about reviewing the coolest gadgets, from cutting-edge AI tech to the latest mobiles and laptops. My passion for new technology shines through in my detailed, honest reviews on opaui.com, helping you choose the best gear out there!