The new family fix

HEVs in Saudi Arabia are no longer just an eco-ideal, but a household necessity. New customs rules, heavy penalties on older cars, and the unique logistics of Hajj and Umrah travel are nudging families toward hybrid SUVs that promise range, reliability and lower lifetime costs. This shift is already changing buying behavior across Riyadh, Jeddah, Makkah and Madinah.

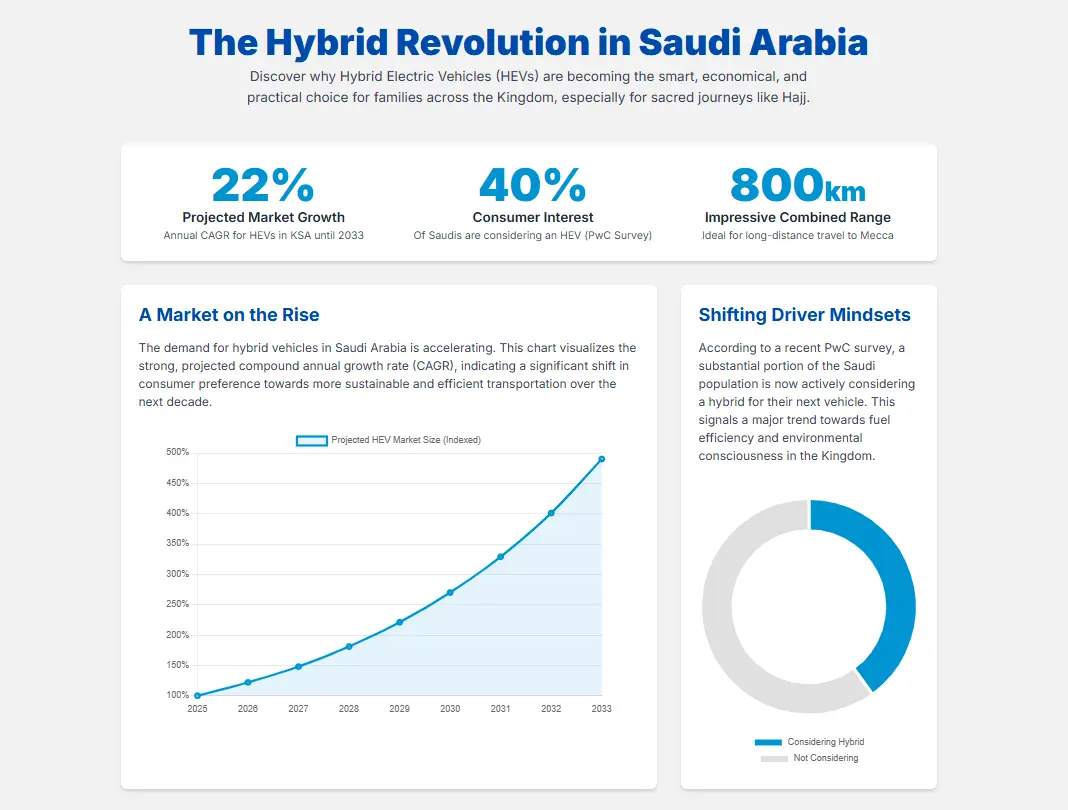

Why the market is moving fast

Industry watchers say the hybrid segment is on a steep growth track driven by national policy and clear consumer economics. Global research groups report rapid expansion in hybrid markets, mirroring strong demand in the Gulf. Major local initiatives to build charging networks run alongside fiscal steps that make inefficient older cars far more expensive to keep, creating a clear economic path to hybrids for many Saudis.

Rules, costs and a strategic nudge

The Zakat, Tax and Customs Authority (ZATCA) enforces strict import rules: used cars older than five years face heavy import fees, and residents can import a private car only once every three years. Penalties for non-compliant, low-efficiency vehicles can reach significant sums or a percentage of the vehicle’s value — making new, efficient models comparatively attractive. These measures channel consumer demand toward new, compliant HEVs.

Ceer EV to Hit Saudi Roads in 2026 — $1.3B Plant, 240k Cars/Year and 30,000 Jobs Promised

Expert voice — infrastructure and industry view

“By building a nationwide, fast-charging network and clear standards, we aim to give drivers confidence to adopt electrified mobility,” said Mohammad Bakr Gazzaz, CEO of the Electric Vehicle Infrastructure Company (EVIQ), explaining the parallel push on infrastructure. EVIQ plans to install fast chargers across more than 1,000 locations and deploy thousands of chargers by 2030. That long-term buildout is visible, but today’s network remains limited on pilgrimage corridors — a key reason hybrids are winning now.

What buyers care about: value over virtue

Recent regional studies show Saudi consumers place huge weight on value and practical benefits when choosing products. Many buyers say “better value” guides brand switches and purchases, and sustainability is increasingly important — but only when it doesn’t conflict with convenience or cost. For car buyers, that means a model that cuts fuel bills, needs less service, and can carry a big family across long distances without charging stops.

The Hajj/Umrah test: why 7-seaters lead

For multi-generational pilgrimage trips, seating and uninterrupted range are non-negotiable. Large 7-seater HEV SUVs such as the Toyota Highlander offer the capacity and combined range families need for long legs between Riyadh, Jeddah, Makkah and Madinah. The Highlander’s price range in KSA (roughly SAR 148,355–199,900) and its hybrid architecture make it a pragmatic alternative to oversized ICE rivals — lower long-term running costs and immunity from BEV infrastructure gaps strengthen its case.

Table: Market snapshot & family model scorecard

| Metric / Model | Value / Starting Price (SAR) | Why it matters |

|---|---|---|

| Saudi hybrid market (2024 est.) — global signals show high CAGR | Rapid growth (industry reports show strong CAGR in hybrids) | Hybrids scaling before full BEV maturity. |

| Toyota Highlander HEV | SAR 148,355 – SAR 199,900 | 7 seats, long combined range — fits Hajj logistics. |

| Toyota Camry Hybrid | SAR ~101,900 | Value sedan — city & highway efficiency |

| Toyota RAV4 Hybrid | SAR ~109,000 | Mid-size SUV — comfort, optional AWD |

Total Cost of Ownership (TCO) — real savings, real caveats

HEVs typically cut maintenance and fuel expenses versus ICE cars, largely because regenerative braking and simplified engine loads reduce wear. Global studies suggest EVs/hybrids can lower service costs substantially, though Saudi conditions—high heat and dust—reduce that advantage somewhat. OEMs must confirm local testing and warranty support so buyers realize the projected ~20% local maintenance savings. If manufacturers don’t adapt cooling and filtration systems for desert conditions, expected savings may be smaller.

Risks, criticisms and balance

Analysts warn the hybrid surge could slow BEV momentum if policymakers rely too heavily on HEVs as a “stopgap.” Investors and OEMs also face engineering challenges: batteries and power electronics need desert-grade validation. Local service networks and certified hybrid technicians will be decisive — otherwise consumer skepticism about 5–10 year reliability could bite adoption rates. Manufacturers that offer extended hybrid-component warranties and local service centres will have a clear edge.

What OEMs and investors should do next

- Prioritize 7-seater HEV or long-range PHEV launches tailored for large families.

- Publicly document desert-resilience testing for batteries and cooling systems.

- Offer extended warranties on hybrid modules and build certified hybrid service centres.

- Integrate telematics that are BEV-ready (EVIQ station maps, charging planning) to signal long-term commitment.

Conclusion of HEVs in Saudi Arabia— short-term winners, long-term transition

HEVs in Saudi Arabia are currently the fastest, lowest-friction route to lower emissions and cheaper household mobility. Fiscal measures and pilgrimage logistics make large-family hybrids a pragmatic choice right now, while EVIQ’s charging rollout prepares the ground for a later BEV wave. For now, hybrids bridge policy aims and practical needs — and market watchers expect the coming five years to decide how quickly Saudi drivers move from hybrid familiarity to full battery adoption.

Hey, I’m Arafat Hossain! With 7 years of experience, I’m all about reviewing the coolest gadgets, from cutting-edge AI tech to the latest mobiles and laptops. My passion for new technology shines through in my detailed, honest reviews on opaui.com, helping you choose the best gear out there!

2 thoughts on “Hybrid Electric Vehicles surge or HEVS in Saudi Arabia — fiscal rules, pilgrimage needs, and a $55B market race by 2033”