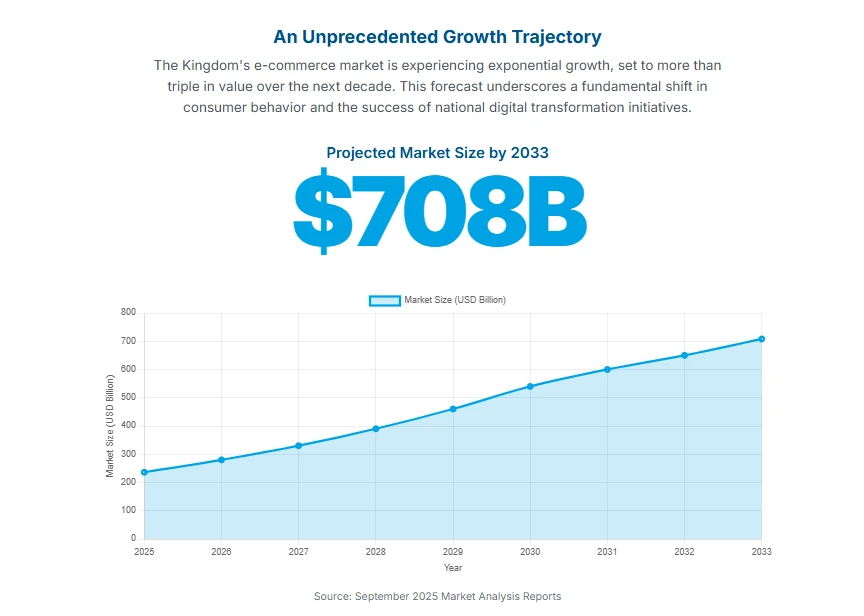

Saudi e-commerce is on the move. Analysts who track the market now say digital commerce in Saudi Arabia could swell to USD 708.7 billion by 2033. That number is huge — more than three times the 2024 estimate of USD 222.9 billion — and it has investors and policymakers paying close attention.

The lead drivers are clear: Vision 2030’s push to digitize the economy, heavy investment in logistics, and rapid adoption of AI and cashless payments. According to government sources, the strategy ties big national projects, improved payments, and smarter supply chains into one fast-growing digital market.

Why does the jump matter

Not all forecasts measure the same thing. Some reports focus only on retail shopping between businesses and consumers (B2C). Those estimates are far smaller. For example, several market firms put conventional e-commerce figures in the low tens of billions. The much larger USD 708.7 billion estimate counts all digital commerce — B2C, B2B (big procurement deals), and C2C (peer-to-peer). That broader view includes high-value contracts tied to Vision 2030’s big infrastructure and development programs.

A Ministry statement on the national digital agenda explains the logic: big public projects and industrial procurement will increasingly flow through secure digital channels. In short, when governments and firms buy at scale online, market totals grow quickly.

Macro foundations: people, policy, and pipes

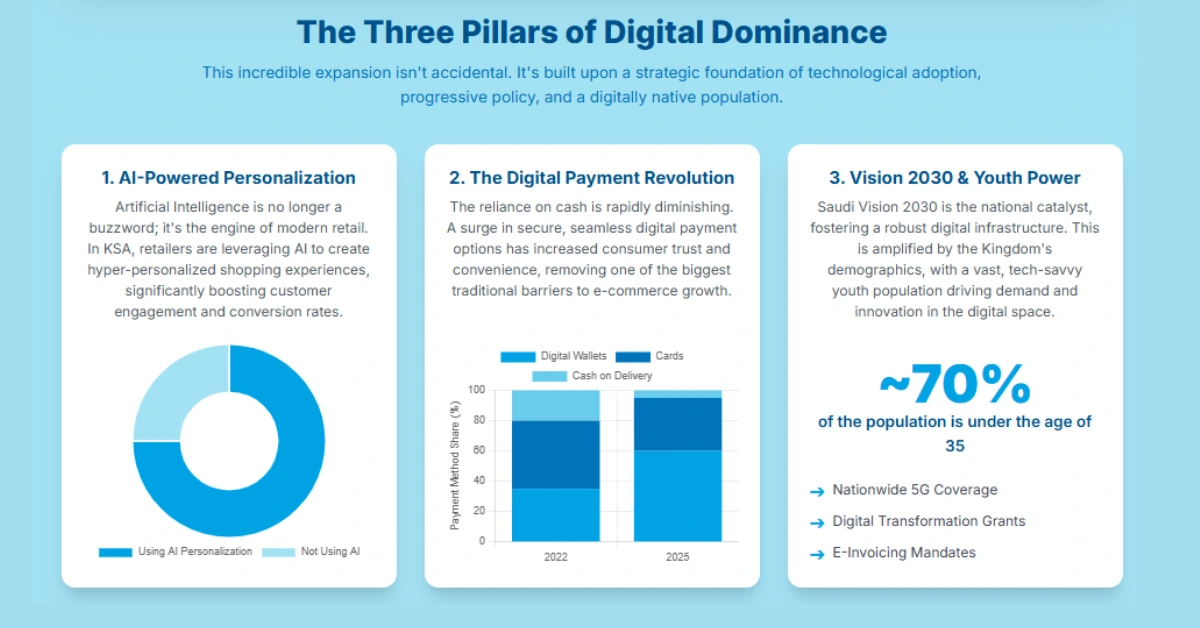

Saudi Arabia’s population is young and mobile-first. Nearly 70% of residents are under 35, and internet and smartphone access is almost universal. That makes consumers ready to shop and engage online every day.

Policy backing is vital. The 2019 E-commerce Law raised consumer protections, required clearer pricing and delivery rules, and tightened data-handling standards. Regulators have also advanced payments infrastructure and licensing for fintechs. Together, these steps make online buying safer and more reliable — a key condition for big-market growth.

Logistics: the backbone of scale

Large e-commerce volumes need strong logistics. The National Industrial Development and Logistics Program (NIDLP) has funneled major investment into ports, airports, rail, highways, and Grade A warehousing. These moves aim to make Saudi Arabia a regional logistics hub and to support temperature-controlled fulfillment for groceries and food categories expected to expand fast.

AI and personalization: turning browsers into buyers

Artificial intelligence is not a nice-to-have — it’s essential. AI powers recommendation engines, fraud detection, inventory forecasting, chat support, and new experiences like AR try-ons. Retailers that use AI often see higher conversion rates. One industry metric shows product recommendations driven by AI can lift conversions by roughly 30%, making every visitor more valuable.

At the same time, AI helps secure the system. Fraud analytics by regulators and banks spot unusual transactions faster, boosting trust in digital payments.

Payments: the cashless leap

Saudi Central Bank (SAMA) policy and the Financial Sector Development Programme have pushed toward a cashless society. Targets aimed for 70% of retail payments to be electronic by 2025 — a goal already largely met. The national payment network, MADA, moved billions in e-commerce volume and new interfaces are simplifying how global and local players plug into the system. Digital wallets and Buy-Now-Pay-Later options are also rising, especially with younger shoppers, lifting checkout conversions.

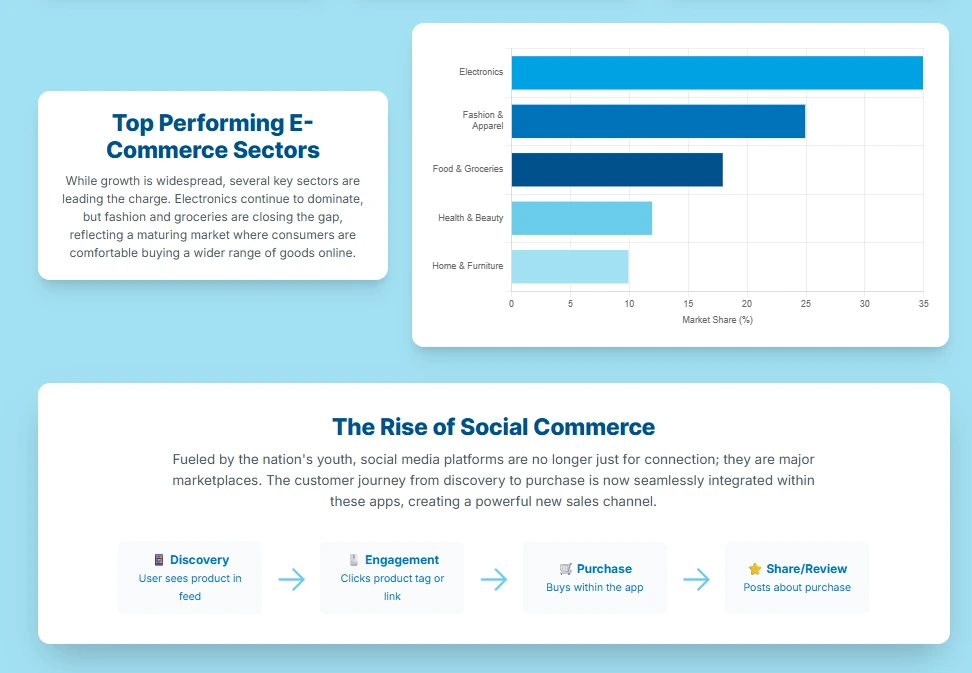

Social commerce: shopping from your feed

Social apps like TikTok and Instagram are more than entertainment — they’re shopping channels. A big share of Saudis discover products through influencers and complete purchases inside apps. Social commerce is projected to become a major slice of total e-commerce by 2025, particularly for fashion, beauty, and impulse buys.

Table: Forecast comparison (simplified)

| Source / Scope | 2024 base | Target year | Projected value | Scope |

|---|---|---|---|---|

| IMARC – All digital commerce | USD 222.9B | 2033 | USD 708.7B | B2C + B2B + C2C |

| Verified Market Research – Retail e-commerce | USD 21.3B | 2032 | USD 56.6B | Conventional B2C GMV |

(Notes: the larger figure counts total digital commerce volume; smaller figures focus on retail GMV.)

Competition and strategy: where investors should look

International giants like Amazon.sa and Noon remain central in retail. But the faster-moving opportunity could be B2B platforms, supply-chain enablement, and services that help mega-projects buy and operate digitally. Experts argue that building procurement platforms, fulfillment-as-a-service, and localized payment integrations will capture disproportionate value.

A senior academic from a Riyadh university notes that while retail competition is intense, the B2B digital procurement market tied to Vision 2030’s multi-trillion commitments could reshape the winner-takes-most dynamics.

Risks and balanced views

The bullish projection depends on several conditions: steady infrastructure delivery, robust cybersecurity, clear regulation, and wide consumer trust. Analysts warn that delays in logistics projects, inconsistent enforcement of data rules, or poor execution by platform operators could slow growth. Likewise, over-reliance on imported technology without sufficient local capacity could raise costs.

Final note: what to watch next

Saudi e-commerce’s future will be shaped by three things: how well AI is adopted, how payments evolve locally and cross-border, and how logistics capacity keeps pace. If these align, the Kingdom could see digital commerce volumes expand dramatically over the next decade. Policymakers and investors will watch NIDLP milestones, SAMA payment reforms, and AI adoption in retail and procurement as early indicators of success.

Experts expect the coming five years to be decisive. For businesses and investors, the practical move is to focus on B2B enablement, hyper-personalization, and full integration with local payment rails to capture growth as the market matures.

Hey, I’m Arafat Hossain! With 7 years of experience, I’m all about reviewing the coolest gadgets, from cutting-edge AI tech to the latest mobiles and laptops. My passion for new technology shines through in my detailed, honest reviews on opaui.com, helping you choose the best gear out there!