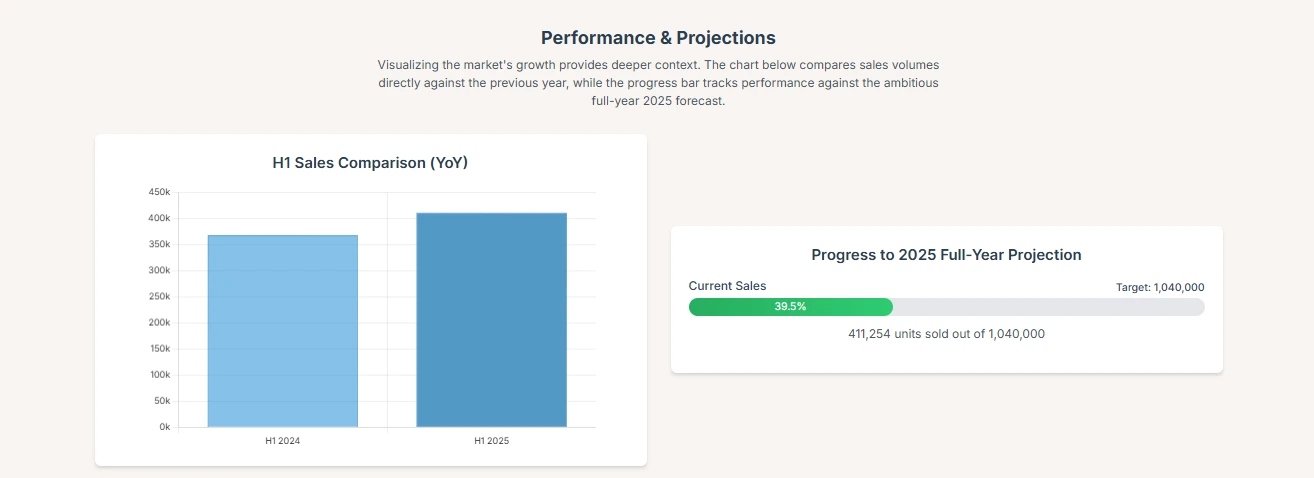

Saudi auto market momentum is real — and it’s reshaping who sells what, to whom, and at which price. Between January and June 2025, new-vehicle registrations in the Kingdom hit 411,254 units, an 11.6% year-on-year rise that industry groups and dealers say reflects stronger household spending and heavy government infrastructure demand.

A market on the move

The jump in H1 underlines how Vision 2030 spending and higher disposable incomes are pulling shoppers back into showrooms. Analysts now debate whether the market can sustain that pace — some local estimates point to an ambitious 1.04 million units for full-year 2025 if H2 accelerates sharply. That target will depend on both commercial fleet awards and how mid-level brands recover.

Why growth is happening

Two big forces are at work. First, non-oil growth and massive public projects support logistics and commercial vehicle demand. Second, consumer pockets are deeper: more Saudis can afford financed sedans and occasional trade-ups to SUVs. The country’s broader GDP outlook and fiscal planning also give lenders and dealers room to offer attractive finance packages. Reuters notes Riyadh’s broader fiscal and growth planning as central to this push.

“Aramco is exploring a number of ways to potentially optimise transport efficiency, from innovative lower-carbon fuels to advanced powertrain concepts,” said Ali A. Al-Meshari, Aramco Senior Vice-President, highlighting partnerships that will shift the vehicle mix toward electrification over time.

Market shape: who’s winning and who’s slipping

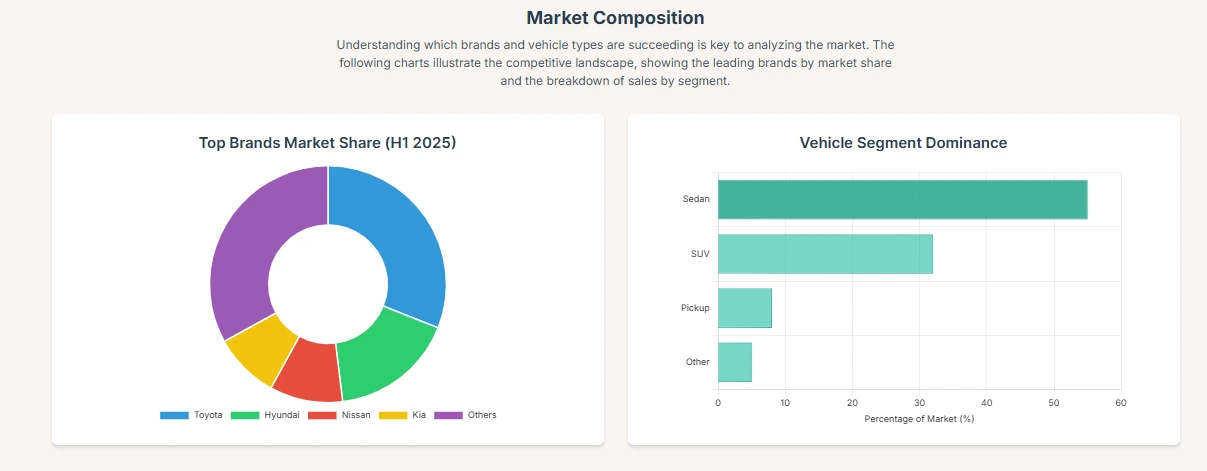

The H1 leaderboard still reads like a classic Asian story: Toyota (Toyota) remains the top brand, with estimates in the high-20s percent range of market share. Korea’s Hyundai (Hyundai) and Kia (Kia) together hold roughly the low-20s percent, anchored by low-cost, high-volume sedans such as the Accent and Pegas. Mid-market challengers — notably Mazda (Mazda) and some specialty Chinese entrants like Jetour (Jetour) — posted the strongest percentage gains, while some broad Chinese portfolios saw declines in H1 as buyers favoured established aftersales networks and familiar powertrains.

Segmentation: sedans still rule — for now

Saudi buying behavior looks uniquely bifurcated:

| Metric | H1 2025 Value | Why it matters |

|---|---|---|

| Total H1 sales | 411,254 units | Confirms strong rebound in demand. |

| H1 YoY growth | +11.6% | Market showing structural expansion. |

| Sedan dominance (below SAR 120,000) | Majority share | Affordability + financing drives volume |

| SUV dominance (above SAR 120,000) | Mid/high end near-monopoly | Family utility, off-road culture, status |

Sedans lock the affordability tiers (sub-SAR 120,000), especially in the SAR 50,000–80,000 bracket, while SUVs dominate the family and premium brackets. OEMs must decide: chase volume in sedans or margin in SUVs. (Note: price bands cited reflect dealer and industry segmentation used across H1 reporting.)

Why the Suzuki Alto Still Rules Saudi Streets in 2025 — Cheap, Tough, and Surprisingly Practical

Commercial vehicles and electrification — twin tailwinds

Large public projects and e-commerce growth are powering light commercial vehicles (pickups, vans). The Saudi commercial vehicle market — valued in recent reports at several billion USD — is expected to grow further as logistics expand. At the same time, strategic partnerships are nudging Riyadh toward electrification: Aramco’s R&D links with global EV players and government objectives for more chargers point to a long-term shift in fleets and private cars.

Risks that could blunt the H2 sprint

Industry watchers list three main risks for the second half:

• Chinese brand rebound execution — H2 recovery by major Chinese players is crucial if the market is to reach the 1.04M projection.

• Financing cost — Higher interest rates would hit the affordability-driven sedan segment the hardest.

• Supply chain — Ongoing part shortages or shipping delays could limit availability of best-selling models and slow the H2 push.

What OEMs and buyers should watch next ?

Established players like Toyota (Toyota) should keep broad portfolios — from rugged pickups to HEVs — while Korean brands must protect affordability tiers with strong finance offers. New entrants need local product focus: niche lifestyles (outdoor SUVs) or quality perception moves are paying off. Finally, electrification readiness — chargers, local partnerships, and fleet pilots — will separate leaders over the next three-five years.

Conclusion — context, not hype

H1 2025 shows the Saudi auto market is growing on a structural footing: policy, projects, and rising incomes all add up. Whether the Kingdom reaches that 1.04 million-car mark depends on H2 execution across supply, finance, and brand strategies. For now, dealers and manufacturers say the next six months will reveal whether this is a cyclical uptick or the start of a new decade of demand. If you follow car markets, this is one to share — it will matter for buyers, fleets, and policymakers alike.

Data source:

Hey, I’m Arafat Hossain! With 7 years of experience, I’m all about reviewing the coolest gadgets, from cutting-edge AI tech to the latest mobiles and laptops. My passion for new technology shines through in my detailed, honest reviews on opaui.com, helping you choose the best gear out there!

2 thoughts on “Saudi auto market jumps 11.6% in H1 2025 — can the kingdom hit 1.04M cars this year?”

Comments are closed.